PITTSBURGH, Oct. 24, 2016 – PNC Bank, N.A. has launched Fiduciary Investment Services through PNC Retirement Solutions®, adding the role of investment fiduciary to PNC’s defined contribution plan offering.

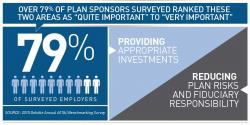

“With the Department of Labor’s continued focus on fee transparency and fiduciary responsibilities, we are helping our retirement plan sponsor clients mitigate their risk by taking on the fiduciary role of advising on or managing investment lineups and providing fund options and services suitable for the particular needs and abilities of their workforce,” said Bonnie Fawcett, managing director for PNC Retirement Solutions.

New Service Options

PNC is offering two new services: a non-discretionary 3(21) Investment Advisory Service and a discretionary 3(38) Investment Management Service. The first will provide assistance with selecting and monitoring the investment options to be offered to plan participants, while allowing the plan sponsor to maintain discretion over the plan’s investment lineup. For the discretionary 3(38) Investment Management Service, three types of investment lineups, built for different plan demographic profiles, will be available to plan sponsors and PNC will assume full discretion over fund selection, monitoring, and replacement.

PNC Retirement Solutions added Fiduciary Investment Services to better serve clients who utilize its Vested Interest® bundled defined contribution solution and do not work with an independent investment fiduciary. These services will also be offered on a stand-alone basis to plan sponsors that do not wish to change their current plan recordkeeper at this time. Vested Interest will continue to offer bundled defined contribution plan services without Fiduciary Investment Services to plan sponsors who have appointed a third party investment advisor.

“We have introduced a refined level of fund screening and monitoring that will assist plan sponsors in meeting their obligations under ERISA and ensure that their employees are well served as they invest and plan for retirement,” said Fawcett.

PNC Retirement Solutions has provided trustee, recordkeeping, compliance, and education services for the defined contribution industry for 24 years. To learn more about Fiduciary Investment Services visit pnc.com/retirementsolutions.

PNC Bank, National Association, is a member of The PNC Financial Services Group, Inc. (NYSE: PNC). PNC is one of the largest diversified financial services institutions in the United States, organized around its customers and communities for strong relationships and local delivery of retail and business banking; residential mortgage banking; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management. For information about PNC, visit www.pnc.com.

The PNC Financial Services Group, Inc. (“PNC”) uses the marketing names PNC Retirement Solutions® and Vested Interest® for defined contribution plan services and investment options provided through its subsidiary, PNC Bank, National Association (“PNC Bank”), which is a Member FDIC. PNC Bank also provides custody, escrow, and directed trustee services; FDIC-insured banking products and services; and lending of funds. PNC does not provide legal, tax, or accounting advice unless, with respect to tax advice, PNC Bank has entered into a written tax services agreement. PNC does not provide services in any jurisdiction in which it is not authorized to conduct business.

“Vested Interest” and “PNC Retirement Solutions” are registered service marks of The PNC Financial Services Group, Inc.

Investments: Not FDIC Insured. No Bank Guarantee. May Lose Value.

CONTACT:

Dorsey Tobias

(919) 788-6272

dorsey.tobias@pnc.com