PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the Digital Services Agreement.

PITTSBURGH, March 22, 2017 – The PNC Financial Services Group disclosed today that it has met its 30 percent carbon reduction goal four years ahead of plan. PNC set this goal, along with an energy reduction goal, in 2009 with plans to reduce its carbon emissions and energy consumption by 30 percent by 2020. Since 2009, PNC has reduced its energy consumption by 28 percent and expects to meet its 2020 goal before the end of 2017.

“As we have long been committed to these goals and worked hard every year to make continuous improvement, this progress is especially meaningful,” said Kevin Wade, PNC’s director of Corporate Real Estate. “We recognize that environmental concerns, including climate change, may impact our business, our clients and the communities in which we operate, and that by reducing our operations’ emissions, we can lessen our impact while serving as an example to others.”

PNC’s 2016 Corporate Social Responsibility (CSR) report, which was produced in accordance with the Global Reporting Initiative, the world’s most widely-adopted CSR reporting framework, outlines the bank’s environmental performance, as well as its efforts to consider the best interests of all of its stakeholders. Specifically, it highlights how PNC’s focus on operating with integrity allows the company to reduce its environmental impact, strengthen communities, help customers achieve their goals, and empower employees to grow, all while pursuing the highest standard of ethical business practices and risk management.

“Our commitment to corporate social responsibility is the very embodiment of a philosophy that shapes every decision impacting our customers, communities, employees and shareholders and has never been more important,” said PNC Chairman, President and Chief Executive Officer William S. Demchak. “By doing business with integrity, doing what is right by the people we serve and looking out for the best interests of all of our stakeholders, we have created a culture that enables PNC to thrive and grow.”

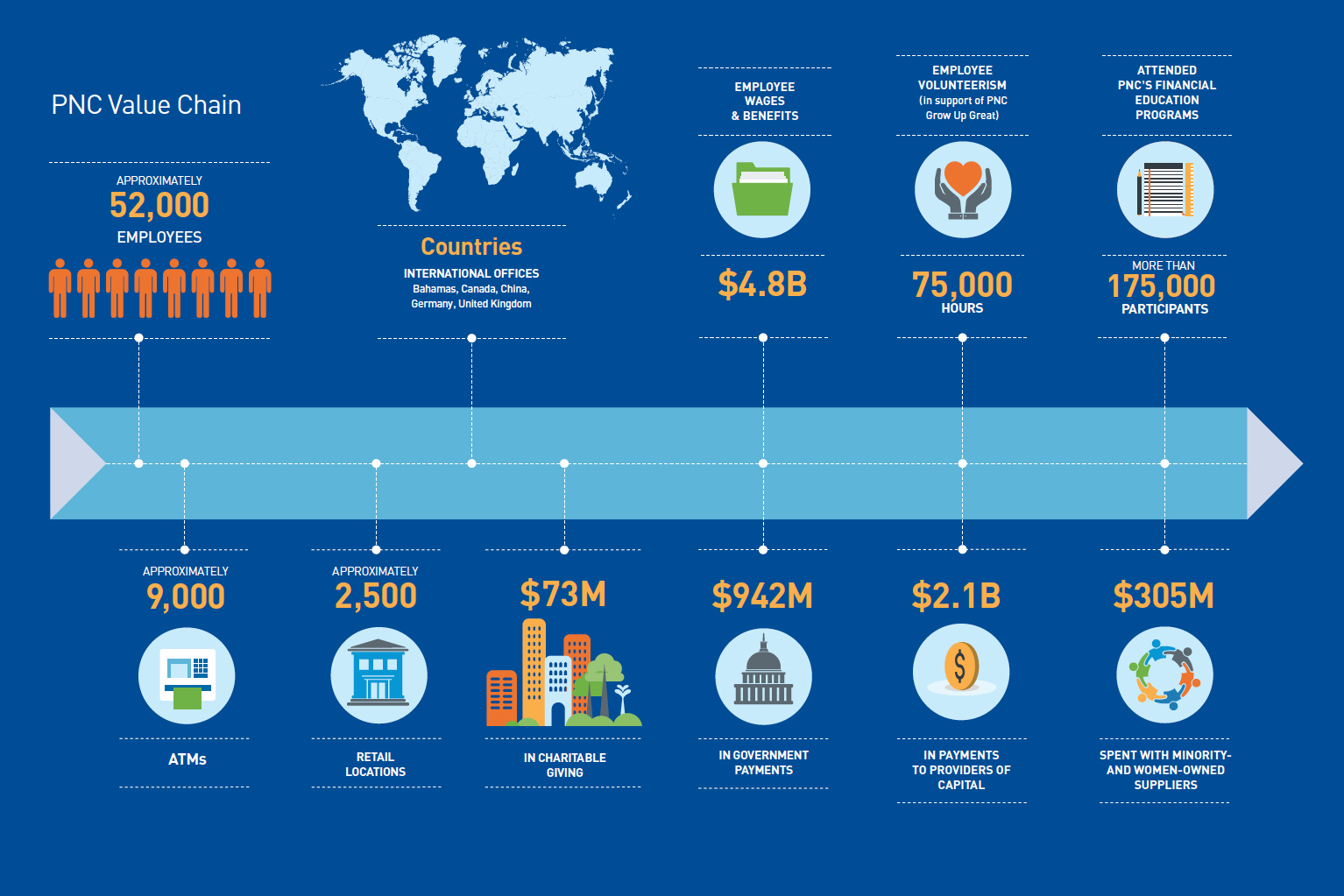

Below are several 2016 highlights that demonstrate this commitment.

Environmentally Friendly Business Practices

- PNC’s net-zero energy branch in Fort Lauderdale, Florida, was recognized with the International Living Future Institute’s Net-Zero Energy Certification.

- In 2015 and 2016, PNC invested more than $5 billion in sustainable financing, including capital for energy efficient and renewable energy projects.

- PNC became a signatory to the Green Bond Principles, guidelines managed by the International Capital Markets Association that provide best practices for underwriting and issuing green bonds.

Environmental and Social Risk Management

- PNC now prohibits new lending to coal producers with anything more than a de minimis exposure to mountaintop removal (MTR) mining.

- PNC introduced a human rights due diligence process focused on select industries with operations that can significantly impact local communities and their residents.

Civic Engagement

- PNC’s total charitable giving in support of education, the arts, and health and human services, among other areas, exceeded $72 million.

- PNC provided $2.4 billion in financing that benefitted low- and moderate-income populations and communities.

- In 2016, PNC was recognized by Fortune as one of The 20 Most Generous Companies of the Fortune 500.

Customer Focus

- PNC installed Instant Card Issuance printers at 87 percent of branches and further enhanced customer security by upgrading its ATM fleet to accept EMV or “chip” cards.

- PNC launched Fundamentos de la Administración del Dinero, a Spanish version of PNC’s Foundations of Money Management, to help Spanish-speaking customers improve their financial literacy and wellness.

- For the second consecutive year, PNC presented a mortgage-free home to a military veteran who was injured during combat operations.

Diversity and Inclusion

- PNC enhanced its maternity and parental leave benefits by granting eligible new parents of any gender six weeks of fully paid leave for birth or adoption. It also grants eligible birth mothers an additional 10 weeks of fully paid maternity leave.

- For the fourth consecutive year, the Human Rights Campaign (HRC) named PNC among the Best Places to Work for LGBT Equality.

- PNC was accepted into Working Mother magazine’s 100 Best Companies Hall of Fame for achieving 15 years as a Working Mother 100 Best Company.

In addition to highlighting key progress, policies and initiatives, PNC’s CSR report features Q&As with several company executives, including Board member Daniel R. Hesse. These Q&As, which provide additional context around specific aspects of PNC’s business, can be found on PNC’s CSR website.

For more information about PNC’s 2016 CSR report and to view PNC’s CSR video, please visit www.pnc.com/csr.

The PNC Financial Services Group, Inc. (NYSE: PNC) is one of the largest diversified financial services institutions in the United States, organized around its customers and communities for strong relationships and local delivery of retail and business banking; residential mortgage banking; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management. For information about PNC, visit www.pnc.com.

CONTACT:

Emily Krull

(412) 762-5654

emily.krull@pnc.com