PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the Digital Services Agreement.

PITTSBURGH, May 4, 2017 /PRNewswire/ -- Optimism among business owners about the U.S. economy and the outlook for their own businesses has reached levels never-before seen in the 15-year history of the PNC Economic Outlook, a biannual telephone survey of small- and medium-sized business owners.

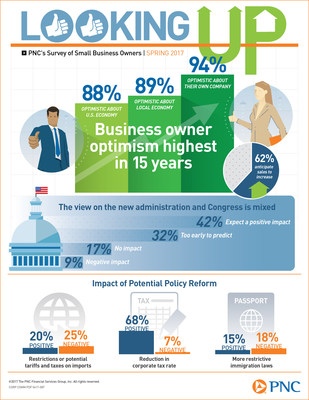

Eighty-eight percent of those surveyed are optimistic about the near-term outlook on the national economy, up from 71 percent in the fall and 56 percent last spring. Eighty-nine percent are optimistic about their local economy, up from 77 percent in the fall of 2016, the survey showed.

"The hope we noted in the fall survey, has for many, turned into enthusiasm and is consistent with other indicators of improved confidence," said Gus Faucher, chief economist of The PNC Financial Services Group. "It remains to be seen, however, if this increase in optimism will convert into improvement in real economic activity."

Economic Optimism Translates to Personal Positivity

Among survey participants, expectations for the performance of their own company also markedly have improved. Ninety-four percent are optimistic about their own company's outlook for the next six months, compared to 85 percent in the fall and last spring.

Further, 62 percent of the business owners surveyed anticipate sales increases in the next six months, the highest since spring 2007; 57 percent anticipate an increase in profits, the highest since spring 2005 and 28 percent expect increased full-time hiring, the highest proportion of businesses since spring 2012.

"Though economic fundamentals have not changed appreciably since the fall, it is encouraging that business owners are anticipating greater sales and profits," Faucher said. "These are key indicators we look for when predicting broader economic growth."

Businesses Casting Hopeful Eye Toward Washington

The survey also examined business owners' thoughts on the new Congress and Administration in Washington, and their view is somewhat mixed. Overall, four in 10 (42 percent) say they expect the policies of the new administration and Congress, in general, to have a positive impact on their business this year. One-third (32 percent) say it's too early to predict and 17 percent say it will have no impact. Only nine percent anticipate a negative effect.

"Business owners are hopeful about the pro-business stance they are seeing from Washington, and are eager to see what regulation and policy changes may be ahead," Faucher said. "But they seem to be taking a wait-and-see attitude, as it takes time for these kinds of changes to generate longer-term impacts."

In fact, only 44 percent of business owners surveyed say they would anticipate a bump in profits if regulations were eased or eliminated. When it comes to hiring, one-third (32 percent) say reductions in regulations would have a positive impact.

Corporate Tax Reform Tops Business Owners' Agenda

When asked specifically about potential policy reform, survey respondents cited corporate tax reform as the single most anticipated change, viewed favorably by nearly seven in 10 business leaders.

But business owners are more evenly divided when it comes to the impact of potential trade restrictions or tariffs: 33 percent are in support, 32 percent oppose and 31 percent are unsure.

A digital package containing national and regional survey results is available on PNC's website at http://pnc.mediaroom.com/digital-packages.

The PNC Financial Services Group, Inc. (NYSE: PNC) is one of the largest diversified financial services institutions in the United States, organized around its customers and communities for strong relationships and local delivery of retail and business banking including a full range of lending products; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management. For information about PNC, visit www.pnc.com.

Methodology

The PNC Economic Outlook survey was conducted between February 9 to March 31, 2017, by telephone within the United States among 1,843 owners or senior decision-makers of small and mid-sized businesses with annual revenues of $100,000 to $250 million. The results given in this release are based on interviews with 500 businesses nationally, while the remaining interviews were conducted among businesses within the states of Alabama, Florida, Georgia, Illinois, Indiana, Michigan, North Carolina, Ohio and Pennsylvania plus Washington, D.C. Sampling error for the national results is +/- 4.4 percent at the 95 percent confidence level. The survey was conducted by Artemis Strategy Group (www.ArtemisSG.com), a communications strategy research firm specializing in brand positioning and policy issues. The firm, headquartered in Washington D.C., provides communications research and consulting to a range of public and private sector clients.

This report has been prepared for general informational purposes only and is not intended as specific advice or recommendations. Information has been gathered from third party sources and has not been independently verified or accepted by The PNC Financial Services Group, Inc. PNC makes no representations or warranties as to the accuracy or completeness of the information, assumptions, analyses or conclusions presented in the report. PNC cannot be held responsible for any errors or misrepresentations contained in the report or in the information gathered from third party sources. Any reliance upon the information provided in the report is solely and exclusively at your own risk.

CONTACT:

Alan Aldinger

(412) 768-3711

alan.aldinger@pnc.com

SOURCE PNC Financial Services Group, Inc.