PNC does not charge a fee for Mobile Banking. However, third party message and data rates may apply. These include fees your wireless carrier may charge you for data usage and text messaging services. Check with your wireless carrier for details regarding your specific wireless plan and any data usage or text messaging charges that may apply. Also, a supported mobile device is needed to use the Mobile Banking App. Mobile Deposit is a feature of PNC Mobile Banking. Use of the Mobile Deposit feature requires a supported camera-equipped device and you must download a PNC mobile banking app. Eligible PNC Bank account and PNC Bank Online Banking required. Certain other restrictions apply. See the mobile banking terms and conditions in the Digital Services Agreement.

PITTSBURGH, Nov. 17, 2016 – PNC Bank, N.A, announced today the closing of the PNC Affordable Rental Housing Preservation Fund 1, LLC, (PNC Fund 1), a $100 million fund to be used to preserve affordable rental housing for families and seniors. PNC Fund 1 is one of the first and largest institutionally-managed funds offered for real estate investors committed to preserving affordable rental housing in the United States.

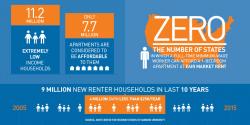

Through the Low-Income Housing Tax Credit Program (LIHTC) of 1986, low- to moderate-income families and seniors have benefitted from affordable rental housing located in neighborhoods nationwide. As a growing number of tax credit properties reach the end of their 15-year tax credit compliance period, the buildings are showing signs of wear, the existing debt is coming due and the original investors may need to exit the partnership.

“The continued availability of affordable rental housing for families and seniors is at risk across the country as a wave of affordable properties are now being sold to owners with little or no interest in maintaining these properties at affordable rents beyond the current contractual period. As these properties are sold, they are at risk of eventual conversion to market rents,” said John Nunnery, senior vice president and manager of Preservation Investments for PNC.

The new PNC Fund 1 will be used to acquire affordable properties at the end of their 15 year LIHTC compliance period as well as other at-risk affordable rental housing. These properties will be held for a period of time and then sold with the intent of recapitalization with new Low-Income Housing Tax Credits, extending the contractual affordability period for another 30 years while delivering financial benefits to participating investors.

“The new fund is an expansion of PNC’s ongoing efforts to ensure affordable housing is available to families around the country through the tax credit capital program. PNC is positioned to recapitalize and preserve the affordability of at-risk projects while providing an attractive risk-adjusted return to our investors,” said Todd Crow, executive vice president and manager of Tax Credit Capital at PNC.

PNC Fund 1 is PNC’s first multi-investor preservation fund, has seven institutional investors, including PNC Bank, N.A., and will be managed by PNC Real Estate.

Originally part of the Tax Reform Act of 1986, the LIHTC program leveraged investor equity, from the private sector to support the development of new and rehabilitated affordable rental housing. The LIHTC program has generated more than 2 million affordable housing units since its inception in 1986.

PNC Bank, N.A., has a comprehensive platform that combines LIHTC equity financing with affordable housing debt solutions to deliver a seamless financing package for the construction or redevelopment of affordable housing. As of Dec. 31, 2015, PNC had nearly $9 billion in affordable housing equity capital raised for LIHTC funds and PNC Fund 1. For more information about the PNC Affordable Rental Housing Preservation Fund 1, LLC, see Affordable Housing Preservation Investments on https://www.pnc.com/realestate.

PNC Bank, National Association, is a member of The PNC Financial Services Group, Inc. (NYSE: PNC). PNC is one of the largest diversified financial services institutions in the United States, organized around its customers and communities for strong relationships and local delivery of retail and business banking; residential mortgage banking; specialized services for corporations and government entities, including corporate banking, real estate finance and asset-based lending; wealth management and asset management. For information about PNC, visit www.pnc.com.

PNC and PNC Bank are registered marks of The PNC Financial Services Group, Inc. (PNC). Bank deposit, treasury management and lending products and services, and investment and wealth management and fiduciary services, are provided by PNC Bank, National Association (“PNC Bank”), a wholly-owned subsidiary of PNC and Member FDIC. Asset–based lending is provided by PNC Business Credit, a division of PNC Bank and PNC Financial Services UK Ltd. (an indirect wholly-owned subsidiary of PNC Bank) in the United Kingdom. PNC Bank and certain of its affiliates, including PNC TC, LLC, an SEC registered investment advisor wholly owned by PNC Bank, do business as PNC Real Estate. PNC Real Estate provides commercial real estate financing and related services. Through its Tax Credit Capital segment, PNC Real Estate provides lending services, equity investments and equity investment services relating to low income housing tax credit (“LIHTC”) and preservation investments. PNC TC, LLC provides investment advisory services to funds sponsored by PNC Real Estate for LIHTC and preservation investments. Registration with the SEC does not imply a certain level of skill or training. This material does not constitute an offer to sell or a solicitation of an offer to buy any investment product. Risks of each fund are described in the funds’ private placement memorandum or other offering documents. Lending and leasing products and services, as well as certain other banking products and services, require credit approval.

CONTACT:

Amy Vargo

(412) 762-1535

amy.vargo@pnc.com